Commonwealth Bank Hits All-Time Highs

On the final trading day in January, the Commonwealth Bank share price hit an all-time high of $118.24. Shares in Australia's largest bank have since traded within touching distance, much to the bemusement of analysts and market onlookers.

Source: Google Finance

Nine have a “sell” rating on the bank, with a further six advising “underweight” positions. There is just one “hold” recommendation. None have a “buy” rating.

The consensus view is that although the bank is a well-run enterprise, the valuation is simply too rich and fails to price in a potential slowdown in the Australian economy.

Valuation Conundrum

For some time, the Big Yellow has traded at a premium to fellow big bank peers Westpac, NAB and ANZ. Currently, the bank trades on a price-to-earnings multiple of 20, which is ~50% more than the remaining big three.

Similarly, the bank has a lower dividend yield than the rest of the big three. At current prices, Commonwealth Bank provides a fully franked yield of 4.0%, compared to an average of 5.5% for peers.

While the dichotomy between analyst price targets and the CBA share price is not a new phenomenon, the goalposts have rarely been this far apart. We take a closer inspection of the difference of views and the recent first-half results released for FY24.

State of Play

Commonwealth Bank is effectively an investment in Australia. The bank generates revenue by writing loans and collecting subsequent interest repayments from residential and business customers.

So, if the economy is doing well, households and corporations are more likely to grow and seek financing. When the economy is weaker, new lending contracts and some customers may fail to service existing obligations.

In the recent interim result, the bank noted the rapid increase in the cash rate from 0.10% to 4.35% has led to an uptick in mortgage payment arrears. Fortunately, this so far has remained below pre-pandemic levels.

Source: Commonwealth Bank

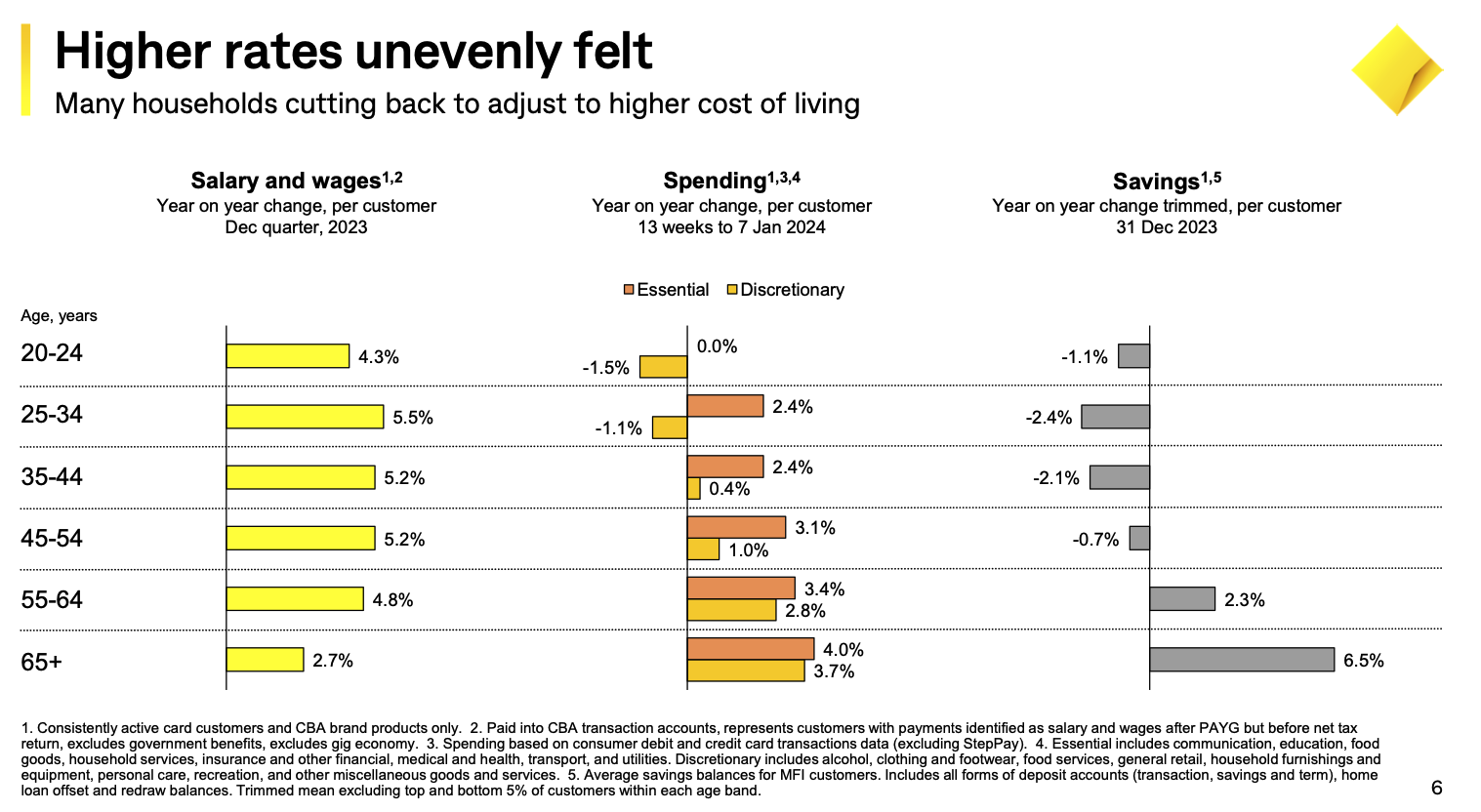

Consumption by younger cohorts has retreated, while older Australians are continuing to spend owing to higher interest from savings accounts. Unemployment has increased to 4.1%, up from a low of 3.4% but in line with historical norms.

All of this indicated a softening in the economy, however, has yet to translate into meaningful repayment or loan losses. The bank has provisioned $6.1 billion for potential losses, compared to its current forecast of $3.9 billion. Furthermore, the dividend is well supported by a 72% payout ratio, which implies profits could fall without dividends being impacted.

Competition Questions

The recent results update from Commonwealth Bank revealed competition has intensified for both deposits and new loans. Earnings decreased by 3% weighed down by a contraction in margins and rising costs.

Operating Income of $13.65 billion

Cash net profit after tax (NPAT) of $5.02 billion

Interim dividend of $2.15 per share, fully franked

With a higher cash rate, customers are shopping around for better deals on their savings while competitors are looking to pry away competitors with sharp pricing. Concurrently, expenses have increased owing to wage inflation and additional technology investment.

Competition has been and always will be a threat to the business. What should comfort investors is the sheer size of the bank; Commonwealth Bank has the widest margins and highest returns on capital.

For the same loan, the company earns more profit that peers and can therefore price more acutely to win over depositors and borrowers. This also contributes to the valuation gap whereby investors place a premium on Commonwealth Bank’s earnings.

The Quality Argument

Historically banks come undone for two reasons. Firstly, the loans are written to poor creditworthy borrowers or against overvalued assets, resulting in defaults and erosion of profits.

Source: Commonwealth Bank

Secondly, when an external shock occurs (such as the pandemic or global financial crisis), the bank does not have sufficient reserves to weather the storm.

Positively, Commonwealth Bank reserves are well above the domestic regulator’s capital requirements and relative to international peers.

Moreover, the majority of loans are written to lenders with higher incomes ($150,000 and above) and sufficient repayment and home equity buffers.

Regarding business loans, at-risk sectors such as commercial property, entertainment and construction comprise less than 9% of the total loan book.

Who’s right?

Commonwealth Bank undoubtedly deserves to trade at a premium to its smaller and less profitable peers. While the valuation undoubtedly appears stretched on conventional metrics, this fails to appreciate the strength of the loan book, existing credit provisions and the resilience of consumer spending.

Disclaimer: Commonwealth Bank is held within client and LPW portfolios.

General Advice Disclaimer:

The information and opinions within this document are of a general nature only and do not consider the particular needs or individual circumstances of investors. The Material does not constitute any investment recommendation or advice, nor does it constitute legal or taxation advice. Zuppe International Pty Ltd (ABN 12 628 405 952) (The Licensee) does not give any warranty, whether express or implied, as to the accuracy, reliability or otherwise of the information and opinions contained herein and to the maximum extent permissible by law, accepts no liability in contract, tort (including negligence) or otherwise for any loss or damages suffered as a result of reliance on such information or opinions. The Licensee does not endorse any third parties that may have provided information included in the Material.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Therefore, any stated figures should not be relied upon. The investment return and principal value of an investment will fluctuate so that an investor’s investments, when redeemed, may be worth more or less than their original cost.