Your Guide to Ethical Investing

The coalescence of investments and values has been gathering momentum, particularly among high-net wealth and next-generation investors.

Ethical investing is a conversation we are having with an increasing number of new and existing clients. The discussion is typically driven by investors who are exploring how their portfolios can be crafted to reflect their values and beliefs while also delivering on their financial objectives.

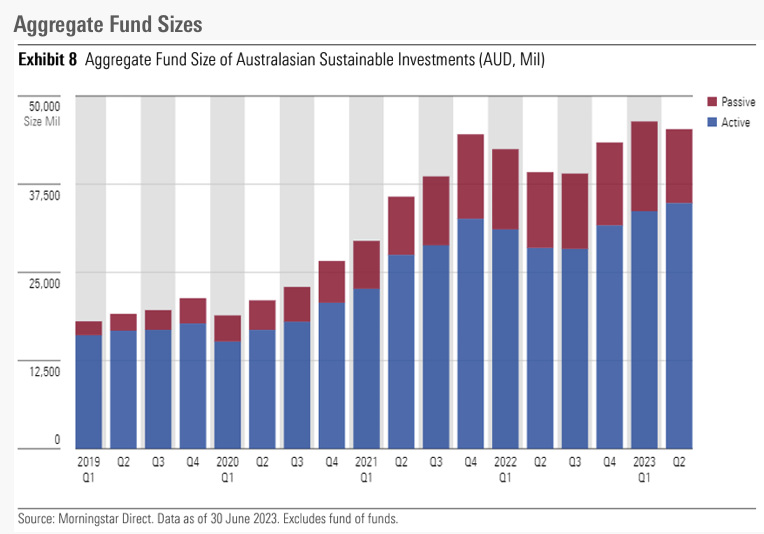

Our anecdotal evidence is backed up by the data, which shows Australians have nearly 5% today (equal to $44 billion) of their capital deployed in sustainable strategies compared to just 2.5% in 2018.

Source: Morningstar

What is Ethical Investing?

Ethical investing integrates one’s values and beliefs into investment decisions.

An investor may be passionate about the environment and therefore direct capital towards a fund that owns companies helping address climate change. Another may wish to avoid organisations with low representation of women in executive positions or have prioritised profits ahead of customers and employees.

Importantly, there is no precise definition of an “ethical investor”. Ethical investing means many things to many people because it’s based on the individual's own experiences, ethics, and morals.

What is ESG?

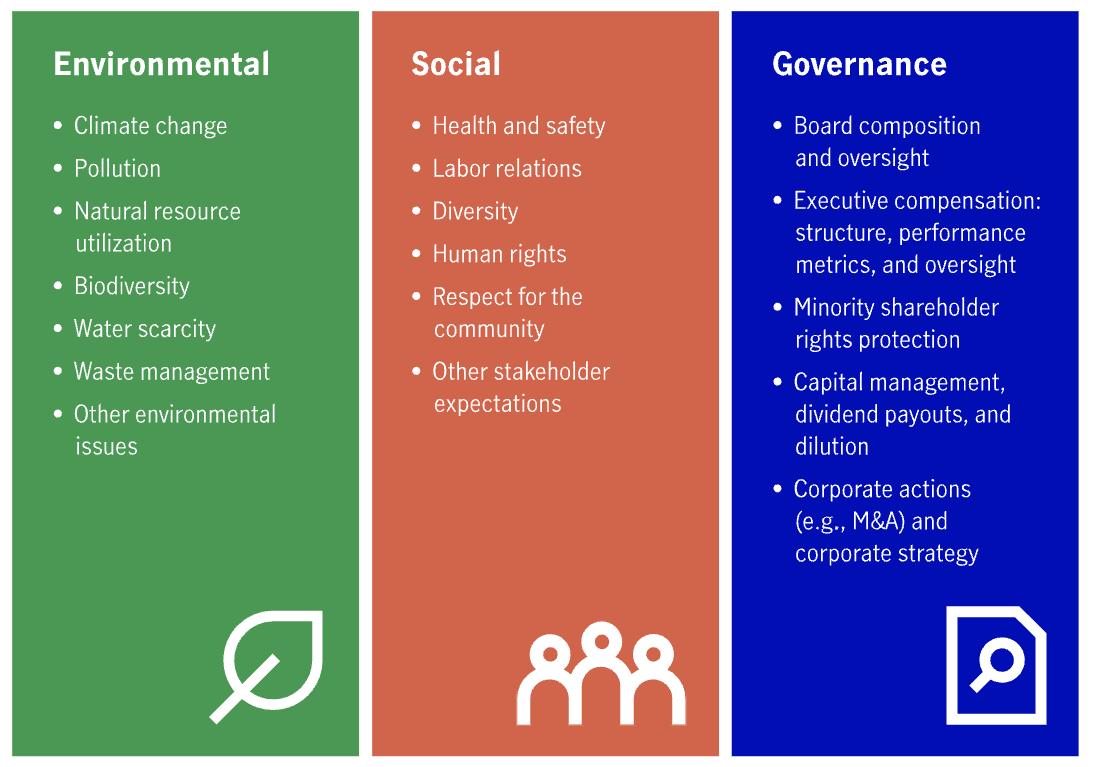

Environmental, social and governance (ESG) is a framework used to measure sustainability. Organisations are graded on their adherence to the three categories, and then typically given a score. The higher the score, the more ethical a company is considered.

Source: Manulife

Does Ethical Investing Impact Returns?

Several academic studies demonstrate ethical investing improves financial returns, while others conclude that ethical investing has no material impact or even leads to subpar results.

The answer however lies somewhere in the middle.

A ten-year appraisal of Australian superfunds revealed sustainable funds return 7.6% annually compared to 7.5% for the typical growth fund. Notably, larger industry funds outperformed competitors that market themselves as pure ESG superfunds.

Similarly, a ten-year study of exchange-traded funds (ETFs) in the US and Europe, collectively investing $97 billion, found ESG underperformed by 0.2% annually. The study also noted that small underperformance could be due to fees, with ESG charging more than non-ESG funds.

How Does Ethical Investing Work?

Most ethical strategies will have some variation of a “screen” or framework (such as ESG) to determine what is and isn’t ethical. The screening methodology will be determined by the investment management or an independent third party.

Negative Screening

A negative screen removes investments based on predetermined criteria. The idea is that companies with poor practices are starved of capital, making it more difficult and expensive to finance operations.

Examples:

Companies that derive more than 50% of revenue from tobacco, weapons and fossil fuel operations

Nations with no net zero targets

Executive leadership teams with less than 30% females

Positive Screening

This method is effectively the opposite of negative screening. Instead of excluding companies based on specific activities of sectors, companies are included based on their operations. This method is more direct at providing capital to causes that directly address environmental or societal issues.

Examples:

Companies that derive more than 50% of revenue from renewable sources

Nations committed to reaching net zero by 2050 or sooner

Executive leadership teams with at least 40% females

Greenwashing

Greenwashing occurs when an organization promotes ethical or green activities when in reality said practices are overstated or seldom exist. Last year the corporate regulator ASIC began action against three asset managers for misleading consumers regarding the sustainability of investment products.

Given the momentum behind ethical investing, it’s little surprise companies and asset managers are looking to capitalise. However, investors need to be cautious of bad actors who are simply projecting green credentials to market products and charge higher fees.

Be sure to read the product disclosure statement (PDS) and where required, discuss any new strategy with a trusted adviser.

How Do I Invest Ethically?

The first step towards ethical investing is to determine what values, beliefs and morals you want to be represented by your capital.

Then you need to evaluate potential options and how they align with your desired objectives. Naturally, this will involve assessing the ethical parameters of the product, but also requires due diligence regarding historic performance, fees and risks.

You also need to be cognisant of how the addition of ethical products impact your overall portfolio. For example, a sustainable fund may have outsized investments in technology, which could tilt a portfolio further towards growth and away from income.

Banking

This technically isn’t investing but still yields a similar outcome.

Your bank deposits and savings are used by the bank to lend to other consumers or businesses. If the lending activities of the bank don’t align with your values, it may be time to look at alternatives.

For example, most Australian banks are restricting, or in some cases ceasing, loans to fossil fuel companies in a bid to retain their social license with customers. The bank’s website is a good place to start reviewing who they lend your money to.

Superannuation

The superannuation system offers a smorgasbord of ethical options. Most industry funds will offer some variation of an ethical option. If you’d like to go one step further, you can consider ESG-specific funds, although be sure to review the performance and fees charged.

Managed Funds or ETFs

There are several ethical funds and ETFs available to Australian investors to purchase in their SMSFs. Funds can also be direct holdings. This option is appropriate for investors who want to take a basket approach to ethical investing. As always, be sure to review the PDS and the methodology behind what type of companies the funds invest in.

Managed funds typically develop their own sustainability framework which is reviewed by a portfolio manager and analyst team.

The most popular ethical asset managers are:

Australian Ethical

Dimensional Fund Advisers

BetaShares

ETFs are usually passive investments, meaning holdings are not “picked” but rather included or subtracted based on a prescribed negative or positive screen.

The most popular ethical ETFs on the ASX are:

Betashares Global Sustainability Leaders ETF (ETHI)

Betashares Australian Sustainability Leaders ETF (FAIR)

Vanguard Ethically Conscious International Shares Index ETF (VESG)

Direct Investments

This involves conducting your own independent research and purchasing assets, such as bonds or shares, directly. Direct investments mean investors can vote at annual general meetings and have their concerns heard by the organization.

Finishing Thoughts

Ethical investing is a deeply personal endeavor that needs to be tailored to your unique combination of ethics, beliefs and morals. We hope after reading this guide you feel mor-e informed about whether ethical investing is something you would like to pursue.

As always, should you wish to learn more about ethical investing, don’t hesitate to reach out to speak with one of our trusted financial advisers.